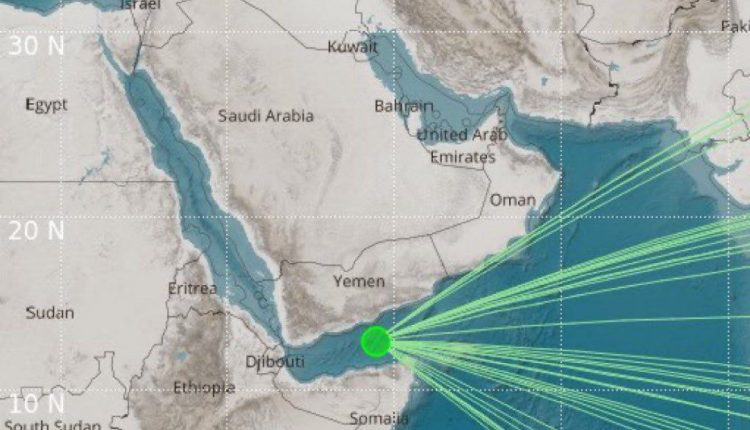

Crude oil and oil product flows through the Bab el-Mandeb Strait have sharply declined in 2024, dropping by over 50% compared to last year, according to the U.S. Energy Information Administration (EIA) in a new report released on Friday. This chokepoint, located at the southern entrance of the Red Sea, plays a critical role in global energy trade. Disruptions here can cause substantial delays in supply chains, leading to higher shipping costs and spikes in global energy prices…

Tensions in the region has been high since earlier this year, with a significant decline in Red Sea traffic following a series of attacks by Yemen’s Houthi militia on commercial vessels in the region, which began in November 2023. As a result, many shipping companies are now opting to avoid the Bab el-Mandeb altogether, taking the longer and more expensive route around the Cape of Good Hope at Africa’s southern tip. This has reduced oil flows through the Red Sea, which averaged 8.7 million barrels per day (bpd) in 2023, to just 4.0 million bpd in 2024.

At the same time, oil shipments around the Cape of Good Hope surged to 9.2 million bpd in the first eight months of 2024, up from 6.0 million bpd in 2023. This shift adds pressure to global energy markets, especially as Europe and other regions heavily rely on these maritime routes for their energy imports, In August, Trafigura, one of the world’s largest independent oil traders, estimated that an extra 200,000 bpd of fuel oil will be consumed by oil tankers alone this year as they are diverted around the Cape of Good Hope, representing a 4.5% increase in annual emissions just from oil tankers alone.

Chokepoints like the Bab el-Mandeb and the Suez Canal are vital for ensuring the smooth flow of oil and natural gas from the Persian Gulf to global markets. Any disruption to these narrow sea routes, even for a short period, can lead to cascading effects on supply, raising costs and potentially destabilizing energy prices worldwide.