Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time. Today, deep into the early decades of the 21st century, and well over 100 years since the not-so immaculate conception of the Fed in the early 20th century…

Gold’s Language

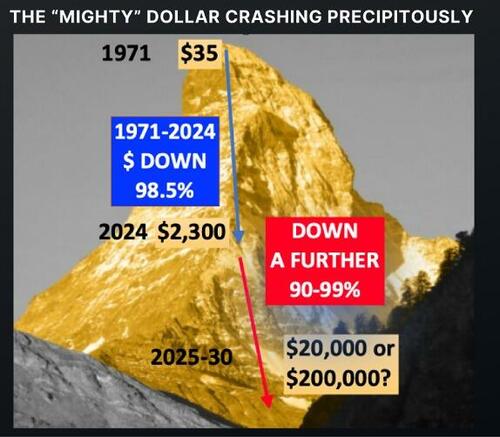

Yet the need, role and direction of gold is fairly blunt, at least for those with eyes to see and ears to hear. History, for example, has some clear things to say about paper money, And so does gold, From the Bretton Woods promises of 1944 and Nixon’s open and subsequent welch on the same in 1971 to the 2001 outsourcing of the American dream to China under Clinton (and the WTO) or the recent weaponization of USD in Q1 of 2022, gold has been watching, acting and speaking to those who understand her language.

The Big Question: Why Is Gold Rising Now?

And this year, with gold reaching all-time-highs, piercing resistance lines and racing toward what the Wall Street fancy lads call “price discovery,” we are understandably getting a lot of interview requests, phone calls and even emails from friends otherwise silent for years and now suddenly asking the same thing:

Toward that end, the list of the fancy and not-so-fancy answers to this question in recent years, articles and interviews could look as simple (or as complex) as the following list of 7 key factors:

The Malignant Seven

- Every debt crisis leads to a currency crisis—hence: Good for gold.

- All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

- Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

- Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

- After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

- The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

- That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold.